The benefits of Credit Insight On-Demand

- Increased decisioning speed and accuracy helps ensure increased competitiveness with more mature organisations

- Easily actioned decisioning outputs tailored to reflect your requirements

- Accesses pre-defined, best practice models optimized for the specific product and market

- Specific model for use with data from Central Credit Register

- Avoids capital expenditure - Experian is responsible for all decisioning and analytics infrastructure

- No requirement for ongoing maintenance

- Easy to access service backed by fast implementation process

- On demand model ensures service level accurately reflect your needs, budgets and available resources

- Services can evolve to reflect changing requirements – easy upgrades, adding more services or niche solutions to meet specific needs

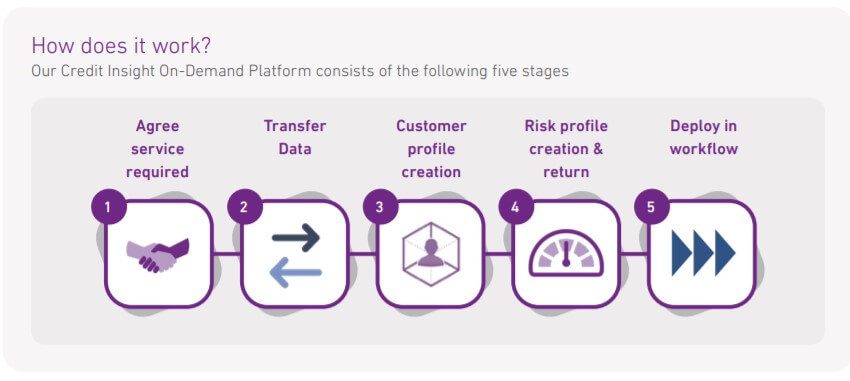

The Approach

Our CREDIT INSIGHT ON-DEMAND PLATFORM enables organisations to better understand individual customer risk and make faster more accurate decisions. It combines data driven insights with best practice eligibility rules for popular financial products, to provide on-demand customer decisioning outputs through a highly cost-effective model.

In this way organisations are able to directly access Experian’s speed, scale and innovation without the need for significant capital investment.

The service can meet your needs for enhanced decisioning accuracy across the lifecycle regarding either individual consumers or small and medium sized business enterprises (SMEs).